DUBAI: The Kingdom’s shopping malls must only hire Saudis under new labor rules, the latest in a raft of initiatives aimed at increasing local employment.

DUBAI: The Kingdom’s shopping malls must only hire Saudis under new labor rules, the latest in a raft of initiatives aimed at increasing local employment.

Human Resources and Social Development Minister Ahmed bin Sulaiman Al-Rajhi issued three new labor directives that are set to transform the country’s retail and restaurant sector, creating 51,000 jobs for Saudi men and women, he said in a statement on Wednesday.

Gulf governments, under pressure to provide more jobs for citizens amid declining oil revenues, are extending localization programs across industries that have in the past relied heavily on expatriates.

The first directive stipulated that only Saudis would be able to work in “closed commercial complexes (malls)” and their management offices.

A limited number of roles would be exempt, but the ministry did not specify which ones.

“The government has made Saudization a very high priority and has made several references to it in recent publications and speeches as part of its Vision going forward,” S&P Global Ratings Director Ravi Bhatia told Arab News. “Anecdotal evidence points to a quickening of momentum.“ The other rule changes were related to raising the number of Saudis working in the restaurant, cafe and catering trade.

The statement did not specify what the new localization rates would be across these sectors.

It is the latest government move to boost the number of Saudis in the workforce. In February, the government introduced restrictions on outsourcing of customer care services through foreign call centers. The previous month, Saleh Al-Jasser, Saudi Minister of Transport and Chairman of the Public Transport Authority (PTA), approved 100 percent localization of ride-hailing services.

Saudi conglomerate Fawaz Abdulaziz Alhokair Co. (Alhokair), one of the Kingdom’s largest retailers, welcomed the announcement. “We are pleased to see fresh Saudization initiatives for the retail sector. These efforts will create new and exciting opportunities for local talent, driving exposure to new sectors and upskilling a powerful section of the local workforce,” Marwan Moukarzel, CEO of Alhokair, told Arab News. However some analysts said the move could be hampered by higher wage expectations among Saudis. “An emerging young Saudi labor force with the skills and incentives to compete for jobs in the private sector would be a positive for the economy and businesses in key sectors,” said Scott Livermore, ICAEW economic Adviser and chief economist at Oxford Economics. “However, a positive outcome is easier to achieve in some sectors than others. Issues sectors may face are shortages of qualified Saudi workers, higher wage expectations for Saudi workers and a reluctance for Saudis to do all the jobs expats do, especially lower skilled jobs. These issues can lead to businesses facing higher costs and lowering profitability, and potentially being counterproductive in terms of increasing Saudi employment.” Other Saudization initiatives announced this year include a goal of 30 percent nationals in accountancy, while a target of 20 percent was set for engineering in August 2020.

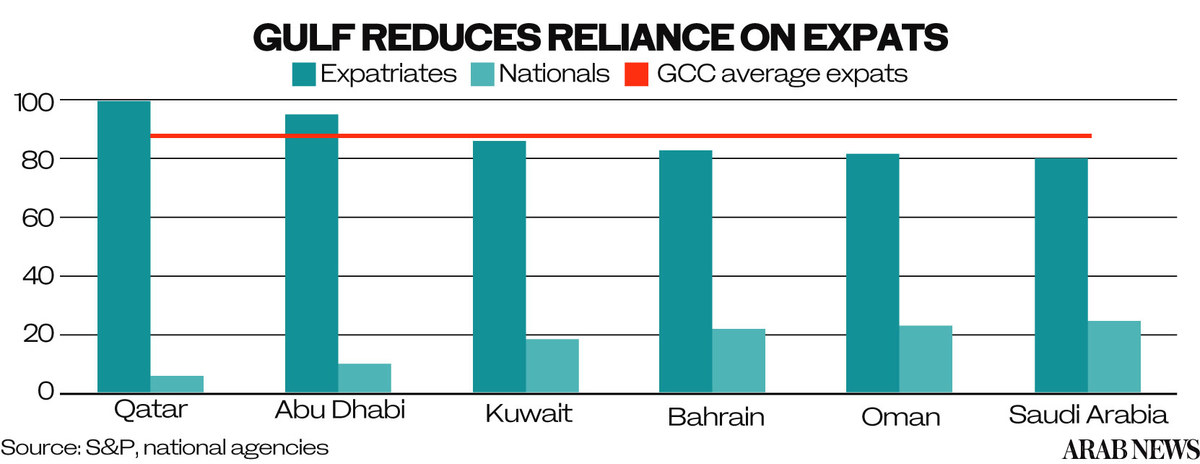

The population across the GCC declined by about 4 percent in 2020 due to an exodus of foreign workers spurred by subdued non-oil sector growth and nationalization policies, according to estimates by S&P Global Ratings. The departures were highest in Dubai, followed by Oman, Qatar, Abu Dhabi and Kuwait.

“The GCC's high dependence on expat labor, especially in the private sector, has stymied its development of human capital in the national population,” S&P credit analysts led by Zahabia S Gupta wrote in a research report in February. “The majority of the local workforce is employed by the public sector, which weighs on governments' fiscal positions, especially in times of lower oil prices.”

Saudi Arabia has the lowest dependence on foreign labor among GCC countries at about 77 percent, while Qatar has the highest at about 94 percent, S&P data show.

The Kingdom introduced its nationalization scheme, Nitaqat, in 2011.